This article expands on an essay/tweet I posted last week.

Many startups/VCs are looking at rolling up small companies in fragmented industries and applying tech/AI to build a profitable business. For example, Thrive and Bessemer invested in a rollup of accounting firms recently.

I think a lot of investors see fragmented markets as a positive. Companies in these markets are often low-tech, inefficient, and run by traditional mom-and-pop owners. Think of how much more efficient you can be with professional owners, better technology, and benefits from scale!

But I often start from the inverse: The fact that inefficient, low-tech operators are still in business should tell you something about the nature of the market and the benefits from scale. If the gains from scale were large enough, you’d usually expect consolidation to have happened already.

In other words, markets are usually fragmented for a reason: weak or no network effects, low barriers to entry, no economies of scale, etc.

It’s why social media markets are not fragmented, given the strong network effects that make a 1m member social media app infinitely better than a 100 member one. Renovation markets are the opposite: Highly fragmented because there are very few network effects beyond small geographies and few economies of scale from being very large.

Fragmented markets can change

Fragmentation isn’t some fixed law for a given market. Big technological or regulatory changes1 can impact markets and increase or decrease fragmentation. These can lead to great investing opportunities and plenty of private equity firms have taken advantage of these types of trends.

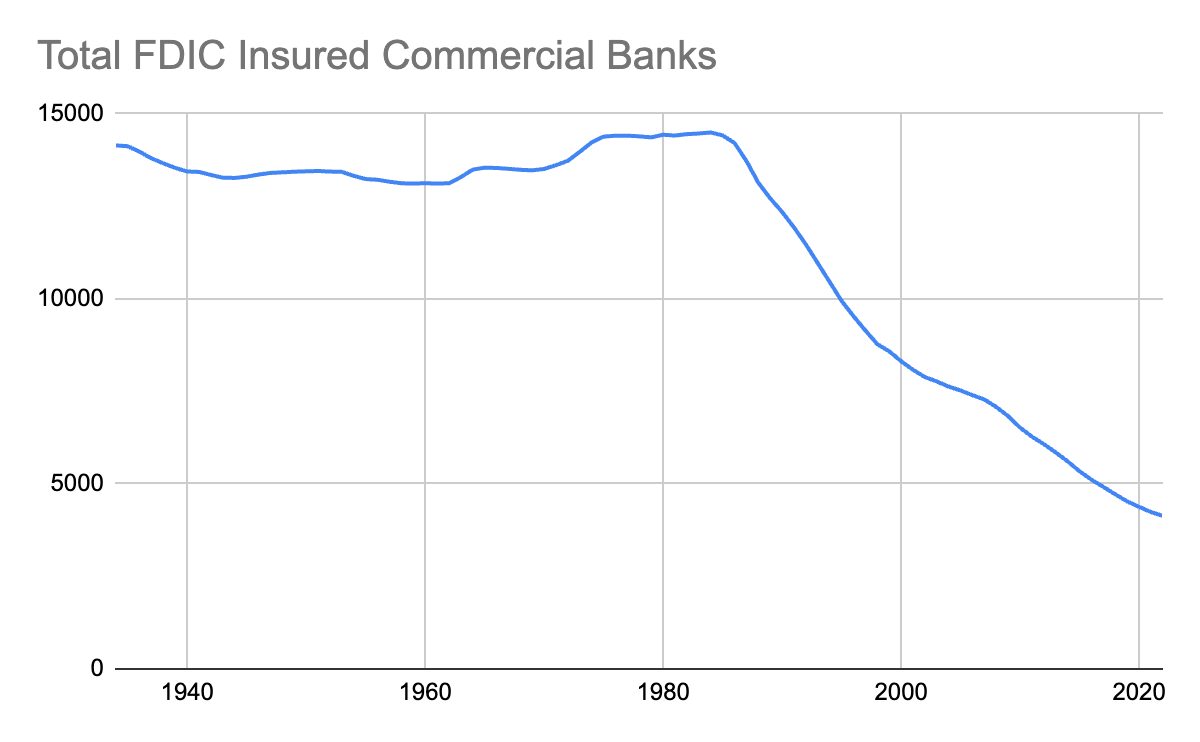

For example, banking has undergone huge consolidation since 1990, as we’ve seen the collapse of community and regional banks. The internet made regional network effects a lot weaker by letting companies easily sell without a regional presence, and huge regulatory burdens made it hard to be a small bank. Health care has seen a similar consolidation trend across hospitals and insurers recently due to increased regulations.

On the flip side, we used to only have a few newspapers and news shows in a market. Then the internet reduced barriers to entry and created an explosion of news across social media and online news sites.

AI as a “why now”

This is the “why now” question I’m interested in answering for AI. In the last technological shift (internet + software), many services markets stayed fragmented and the winning strategy for tech companies was to sell vertical SaaS, not be a tech-enabled services business (ex: ServiceTitan for renovation, Toast for restaurants).

As I’ve written before, this time might be different. AI-enabled services businesses could succeed this time because the gains from implementing AI are so big and it could take too long for existing businesses to catch up with off-the-shelf software.

Even if this is true (and the jury is still out),2 it still leaves the question of whether to build a company from scratch or roll up existing ones.3 The argument for rollups seems to be that you are buying distribution. In markets where customer acquisition is challenging, buying cheap businesses with existing distribution can be an effective strategy.

But applying new technology to old-school businesses can be harder than building something from scratch, even more so when you’re simultaneously consolidating multiple companies. Historically, private equity rollups have stuck with more straightforward cost optimizations rather than technological transformations for this reason.4

That’s all to say for some markets, and the right teams trying it, rollups may work well. But it’s critical for any company approaching a fragmented market to explain the “why now” clearly. Saying "we have AI now" doesn't necessarily overcome the entrenched forces maintaining market fragmentation, just as "we have better software" fell short in the last cycle.

There are other causes too: cultural, demographic, etc. In Byrne Hobart’s recent post on this topic, he made an interesting argument for demographics to drive changes today: “…there are potentially opportunities in a case where it wouldn't make sense for a new entrant to join, it doesn't make financial sense for incumbents to shut down, but it does make personal sense for the founder to step back.”

I’m simplifying here as there are a lot of options that blend between these. Yoni Rechtman has proposed doing “software-led growth buyouts” where you combine with one large incumbent instead of trying to roll up smaller ones. Franchising could also be an option.

As one private equity friend put it, many PE funds are just worried about things breaking in their portfolio companies so they try to do the easy improvements instead of anything too ambitious.